- PP: £290,000

- Fees and work: £31,712

- Revaluation: £420,000

- Profit (if sold): £99,867.76

- ROCE*: 31%

- Cash left in: £57,632

- Annual Income: £32,280

- Annual costs: £20,806

- Net Yield: 3.58%

*Return on Capital Employed

Average Income:

£2,500 pcm

The Property

A Grade II listed mixed-use building on Union Street in Ryde on the Isle of Wight. With a high street frontage, the building consists of five floors with a two-storey pharmacy located on the ground and lower floor and flats on the first, second and third floor including a studio flat, two one-bed flats and a two-bed maisonette.

The commercial part of the property is owned by the pharmacy on a long lease. The flats which were in good condition and tenanted remained part of the freehold and so were yet to be legally split into individual titles through Land Registry. This made for an appealing title split project.

The Plan

This title-split project was largely a paperwork exercise with some minor physical improvements required on the property. Being a mixed-use listed building with the commercial part sold on a long lease to a third party, complications were expected, so we bought the block with cash rather than with a bridge loan.

Blocks of flats tend to sell only to investors, who expect a discount. Individual flats, however, can achieve full value with homebuyers. This allowed us to purchase the block at a 31% discount. The plan was simple: create leases for each flat and mortgage each of them at their individual values.

To do this, we set up a freehold company and a subsidiary. The freehold company bought the building, the flats were title-split and mortgaged separately, and then transferred into the subsidiary. Individual refinancing unlocked the full values of the flats, increasing the block’s worth from £290,000 to £420,000 — a 45% uplift (or, framed differently, a 31% discount on the final value).

Lessons Learnt – The refinance process took 6 months. Here are a few reasons why:

1. Searches. If purchased via auction, order or renew all searches immediately. In this case, Southern Water took over four months to complete drainage searches, causing mortgage offers to expire and costing £750 in renewal fees plus significant opportunity losses.

2. Mixed-Use Lenders. Mixed-use mortgage options are limited. Only Lendinvest and Landbay offered credible terms; We chose Lendinvest for the better rate. They made conveyancing difficult and refused to indemnify minor issues such as the outstanding drainage search. Despite SDLT savings, the delays outweighed the benefits.

3. Mortgage vs Estate Agent Valuations. Mortgage valuers rely on recent comparable sales—typically five similar properties sold within six months locally. With few two-bed sales nearby, the valuer compared the two-bed against one-beds instead, reducing the valuation to £125,000 (only £10,000 above a one-bed) despite it having nearly double the floor area.

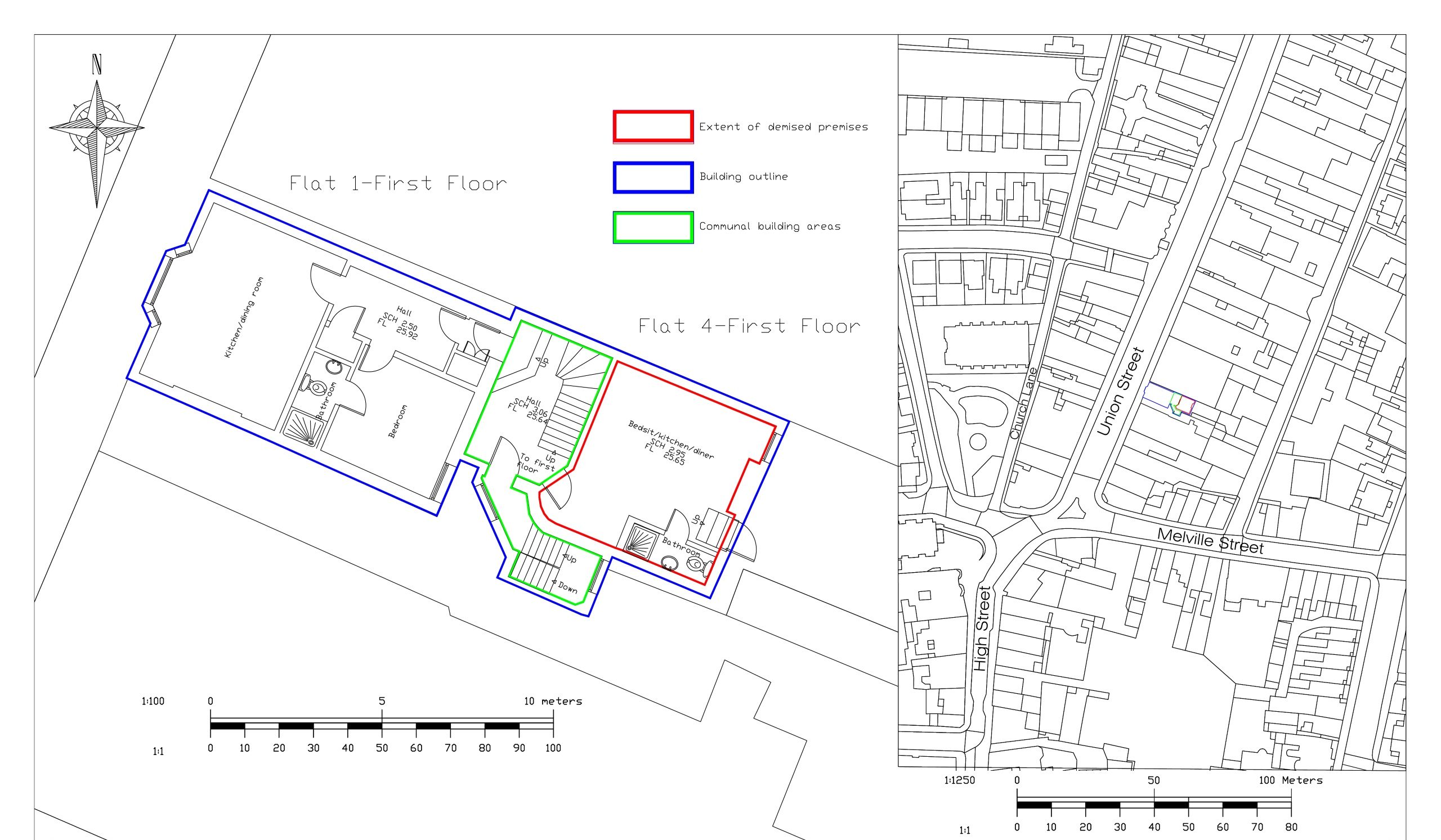

4. Floor Plans. Small drawing errors can cause Land Registry rejection. Have plans prepared early and submitted for a SIM (Search of the Index Map) to confirm boundaries and resolve issues before completion.

5. Fire Risk Assessment. If not done within the last year, commission one immediately—especially for communal areas. Lenders require it, and it highlights safety issues in time to make improvements before refinancing.

Location

34 Union Street, Ryde, Isle of Wight, PO33 2LE